The driving force behind innovation in insurance distribution

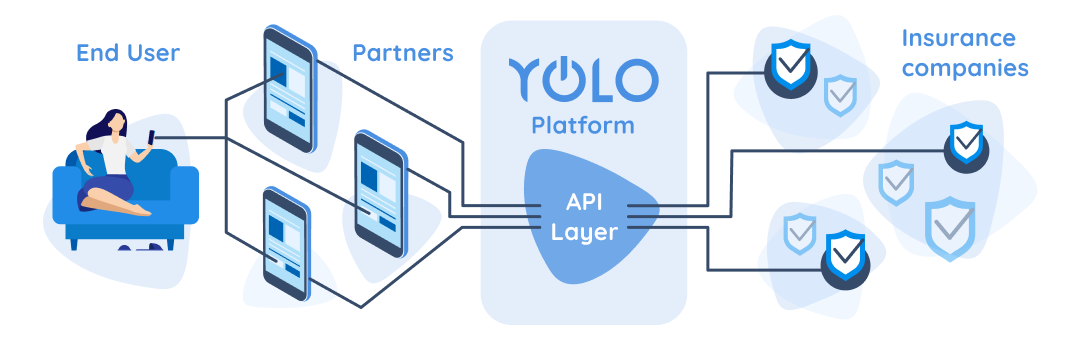

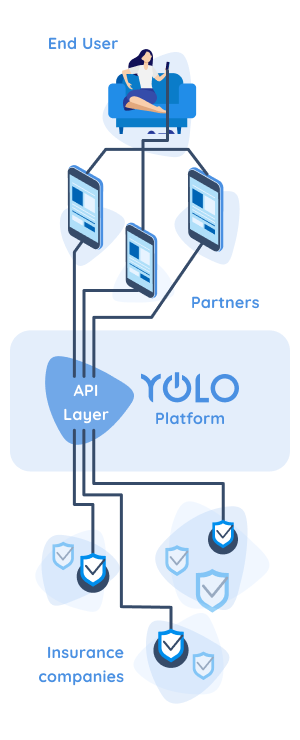

Developed with proprietary technology and perfected over seven years of experience, YOLO‘s digital platform is one of the most advanced solutions for omnichannel distribution available today.

A solution for integrating physical and digital channels that can be used equally by banks, insurance companies, intermediaries and operators who supplement their core offering with insurance products and services (utilities, large-scale distribution, entertainment).

The API-first, multi-tenant and microservices architecture allows insurance offerings to be integrated securely and scalably at every customer touchpoint.

The platform is designed to adapt to the partner’s business model and reduce time to market. There are three key principles:

Scrum

To manage projects in short sprints, with incremental releases and continuous improvement

Design Thinking

To understand the real needs of customers and partners and design high-value journeys

Lean Agile

To iterate quickly and validate each development with real metrics

Why choose the YOLO platform?

Partnership with distributors on embedded products

The YOLO platform includes an embedded offering module through which partners can:

- build new products from preconfigured or customised templates;

- manage pricing, conditions, journeys and sales layouts;

- publish embedded coverage in your channels (app, web, portal, e-commerce);

- monitor performance, conversions and redemptions in real time;

- maintain co-branding and full ownership of the customer experience.

The module integrates governance, compliance and data analytics functions, allowing you to innovate your product portfolio without writing code and with minimal time-to-market.

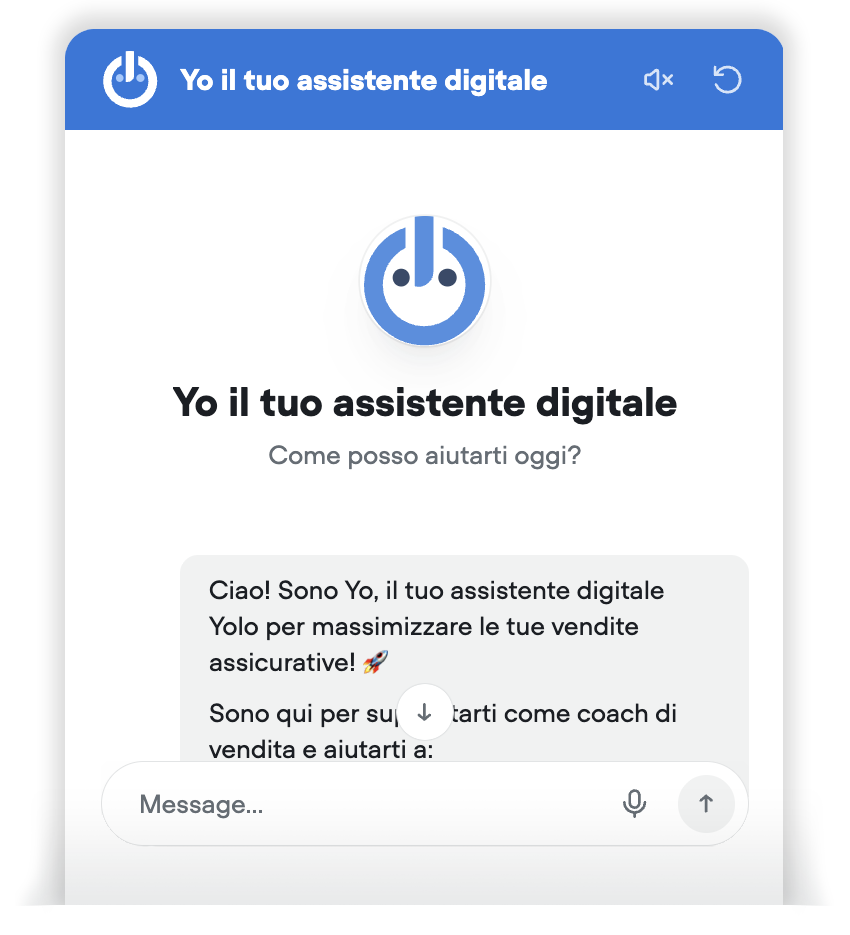

Intelligent distribution

YOLO has developed two virtual assistants based on conversational and generative artificial intelligence, one for the digital channel and the other for the phygital channel, which improve the end-user experience and enhance the sales and consulting activities of intermediaries.

AI Agents:

- accompany users throughout their insurance journey, from quotes to after-sales service;

- assist agents and brokers in proposing the most suitable coverage, improving the speed and accuracy of their advice;

- automate onboarding, quoting, reminders, follow-ups and claims management;

- continuously learn from data and optimise the quality of interactions, increasing conversions and user satisfaction.

Would you like to find out more?

Thanks to native integration with the YOLO platform, AI Agents can be customised for specific brands, languages, tones and use cases (bancassurance, retail, companies or intermediary networks).

They are available on web chat, mobile apps, partner portals and voice channels, with full IVASS compliance and data protection.

Case history

Colere Infinite Mountain

The All-Season Insurance Product for Ski Resorts

ENDU

Insurance for sportsmen against the cancellation of events

TIM MyBroker

Digital and tailor-made insurance solutions for TIM customers

Banca Sella

The new insurance offer that protects account holders against unforeseen events and accidents even for just one day

CA Auto Bank

Revolutionising the concept of insurance by launching on-demand policies

Banco Desio

Digital insurance for account holders that can be purchased directly from mobile phones

Frequently Asked Questions

Can I integrate only some components?

Yes. The platform is modular and can be adopted for individual use cases or in full stack mode.

Do you support multilingual environments?

Yes. The CMS allows you to manage content and languages for different markets.

Which payment methods are supported?

Seamless integration with leading providers (Nexi, Stripe, Adyen, PayPal, etc.) via dedicated gateways.

How do you ensure data separation between partners?

Each tenant operates in isolated environments with dedicated security policies, logs, and audit trails.

Is SSO authentication available?

Yes. The SSO module is compatible with OpenID and SAML, allowing integration with corporate systems and identity federations.

Let’s talk about you

Tell us about your channels and systems: we will show you a personalised activation path and a demo based on use cases in your sector.

Fields marked with * are mandatory